Canara Bank

Canara Bank

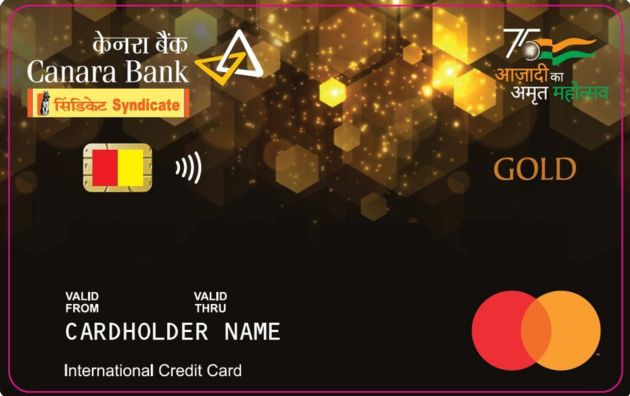

Canara Bank Mastercard Gold Secured Credit Card

Travel

Travel

Best Suited For: Rewards & Travel

Joining Fee: Nil

Annual Fee: Nil

Travel

Travel

Best Suited For: Rewards & Travel

Joining Fee: ₹4,999 Plus Applicable Taxes

Renewal Fee: ₹4,999 Plus Applicable Taxes

Welcome Benefit

Welcome Benefit

Welcome e- Gift Voucher worth Rs. 5,000

Get 5X Reward Points on Dining, Departmental stores and Grocery Spends.

Lounge Access

Lounge Access

Enjoy 2 complimentary Domestic Airport Lounge visits every quarter in India.

Best Feature:- Earn upto 50,000 Bonus Reward Points Anually, Club Vistara and Trident Privilege Membership.

Check your eligibility for this card

.png) Top Credit Cards in India

Top Credit Cards in India